kern county property tax payment

Los Angeles County California sales tax rate details The minimum combined 2021 sales tax rate for Los Angeles County California is 1025. Last day to file property tax exemptions.

Kern County Treasurer And Tax Collector

Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes.

. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Fraud Waste and Abuse in Kern County Government. Kerr County Tax Office Phone.

Child Abuse or Neglect. The County of Kern makes no guarantee ex pressed or implied relative to the title location or c ondition of the properties for sale. Crime Non-Emergency Domestic Violence.

Postal Service determines the payment date. Search for your property. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment.

Look up your property here 2. Payment by Visa Mastercard American Express and Discover Card is accepted online 24 hr. The Kern County California online Tax-Defaulted Property Sale will take place March 14-March 16.

Unsecured personal property tax. Press enter or click to play code. The owner search is the best way to find a property.

These records can include Kern County property tax assessments and assessment challenges appraisals and income taxes. The median property tax on a 21710000 house is 160654 in California. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Kern County collects on average 08 of a propertys assessed fair market value as property tax. When paying by mail include the payment stubs with your check. Deposits are no longer being accepted.

The deadline was 500 PM Pacific Time on March 4. The first round of property taxes is due by 5 pm. The Kern County treasurer and tax collector is warning people not to be late otherwise a.

The postmark of the US. Property Taxes - Pay Online. Request Refund of Court Reporter Fees.

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged. Property Taxes - Pay Online.

Deposits are no longer being accepted. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. Payment by Visa MasterCard American Express Discover Card and Electronic Checks is accepted through the Kern County Treasurer and Tax Collectors website.

Select the property VIEW DETAILS link. Box 541004 Los Angeles CA 90054-1004 An Important Message for Owners of Secured Property Property taxes for the second installment of the secured tax bill are now payable and will become delinquent in 27 days. Property Taxes - Pay by Wire.

Please type the text from the image. Find Kern County Tax Records. You can view the list of items for sale by visiting 03142022 Tax Sale or by clicking on the sales listed in the auction calendar.

The median property tax on a 21710000 house is 227955 in the United States. Child Abuse or Neglect. Payments can be made on this website or mailed to our payment processing center at PO.

Visa MasterCard American Express or Discover cards can be used for payments made online. Last day to pay first installment of regular property taxes secured bill without penalty. - Kern County Treasurer and Tax Collector Jordan Kaufman announces that the deadline for payment of unsecured property taxes is August 31st.

You can view the list of items for sale by visiting 03142022 Tax Sale or by clicking on the sales listed in the auction calendar. The deadline was 500 PM Pacific Time on March 4. The median property tax on a 21710000 house is 173680 in Kern County.

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. You can search for tax bills using either the Assessor Tax Number File number Bill number or the property address. Please write ATNs on your check.

All property taxes currently due will be. See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern County CA. Fraud Waste and Abuse in Kern County Government.

Annual Tax Collection Calendar. Payments can be made online at kcttccokerncaus. Visit Treasurer-Tax Collector for more information.

What is LA county tax rate. Kern County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kern County California. Last day to file a late exemption for homeowners and veterans.

Crime Non-Emergency Domestic Violence. The Kern County California online Tax-Defaulted Property Sale will take place March 14-March 16. Start by looking up your property or refer to your tax statement.

Lien date for the assessment of property on the assessment roll. Join Courts Press Mailing List. A day at wwwkcttccokerncaus A convenience fee will be charged on all card usage.

Kern County California Fha Va And Usda Loan Information

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector

Grant Deed Kern County Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector

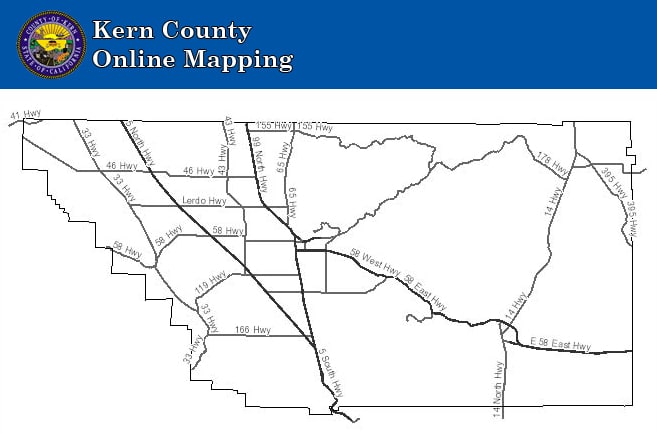

Interactive Maps Kern County Planning Natural Resources Dept

Kern County Property Taxes Due Next Week Kget 17

Kern County Treasurer And Tax Collector

Home Water Association Of Kern County

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Oil Gas Play Key Role For Kern County Public Finances Energy Duke Edu

Supervisorial District 4 Map Kern County Ca

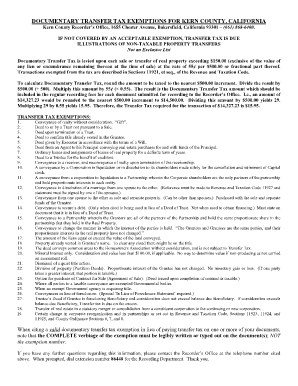

Kern County Assessor Forms Fill Online Printable Fillable Blank Pdffiller

Kern County Sheriff Restraining Order Form Fill Out Pdf Forms Online